defer capital gains tax eis

There is a chargeable gain of 5000 beyond the 2019 CGT tax free allowance of 11700. Loss relief allows you to write off any losses against income tax.

Minimize Defer Capital Gains Taxes Toplitzky Co

HR Block Maine License Number.

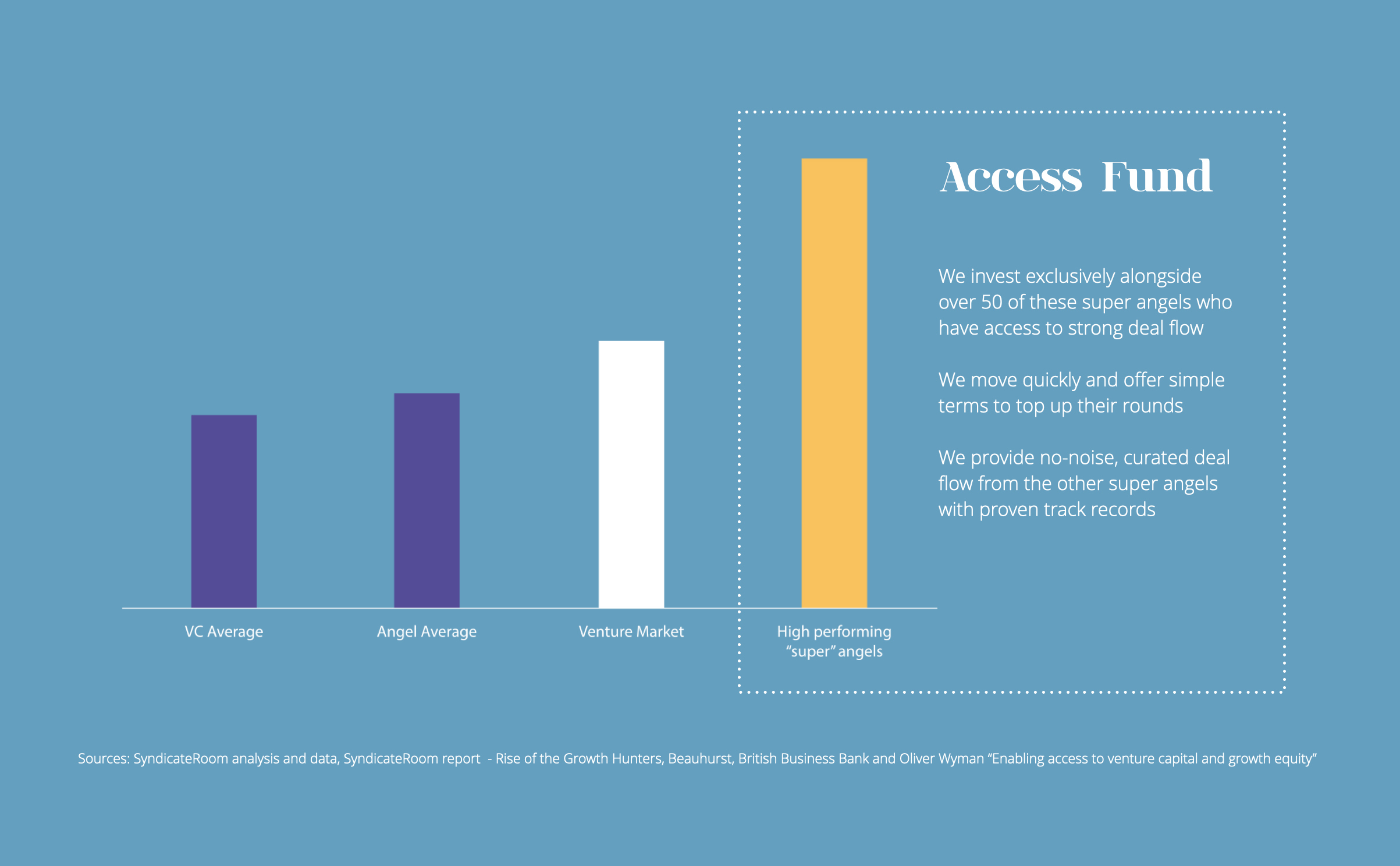

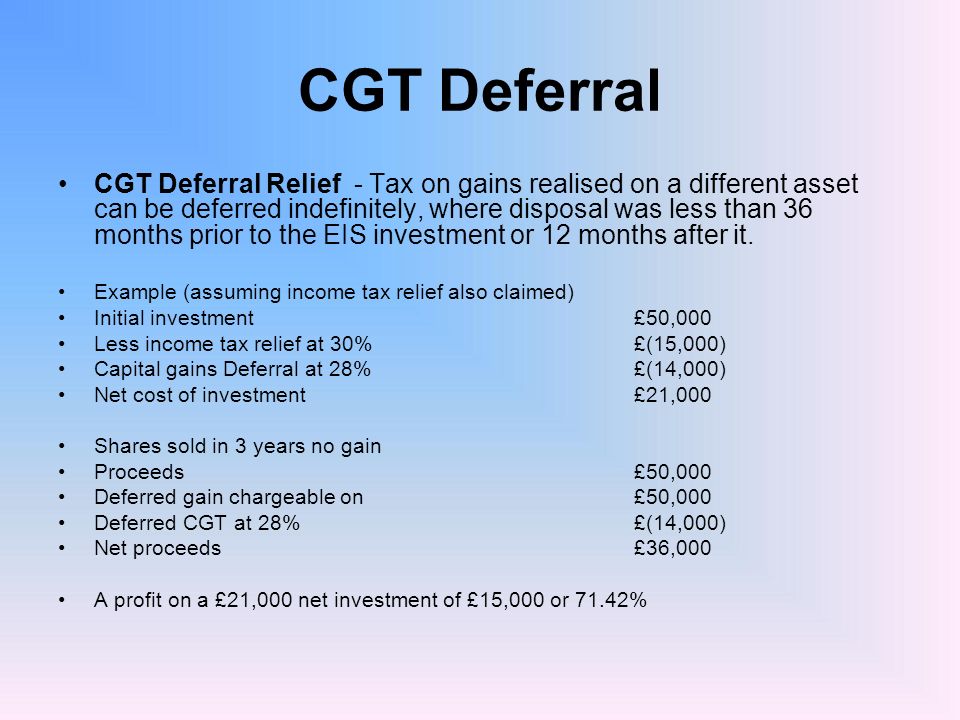

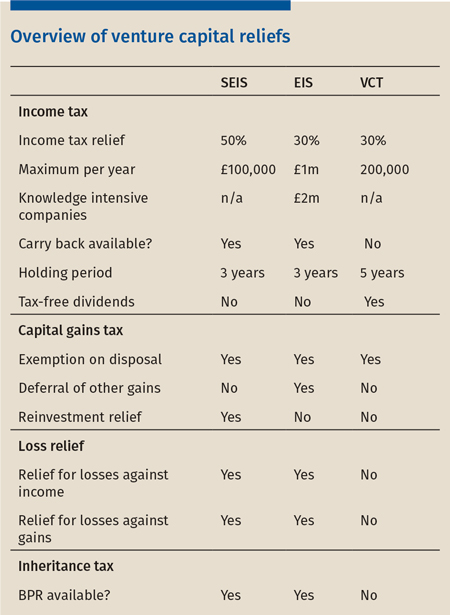

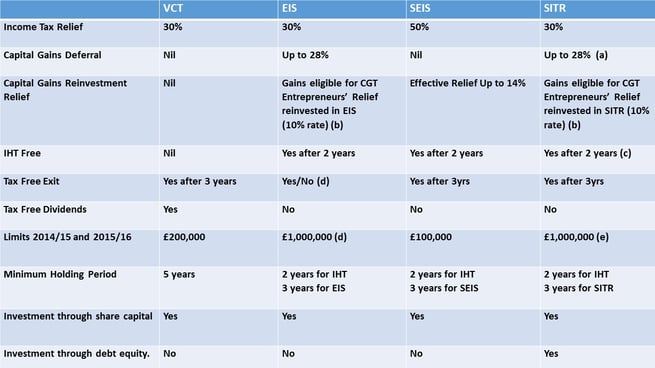

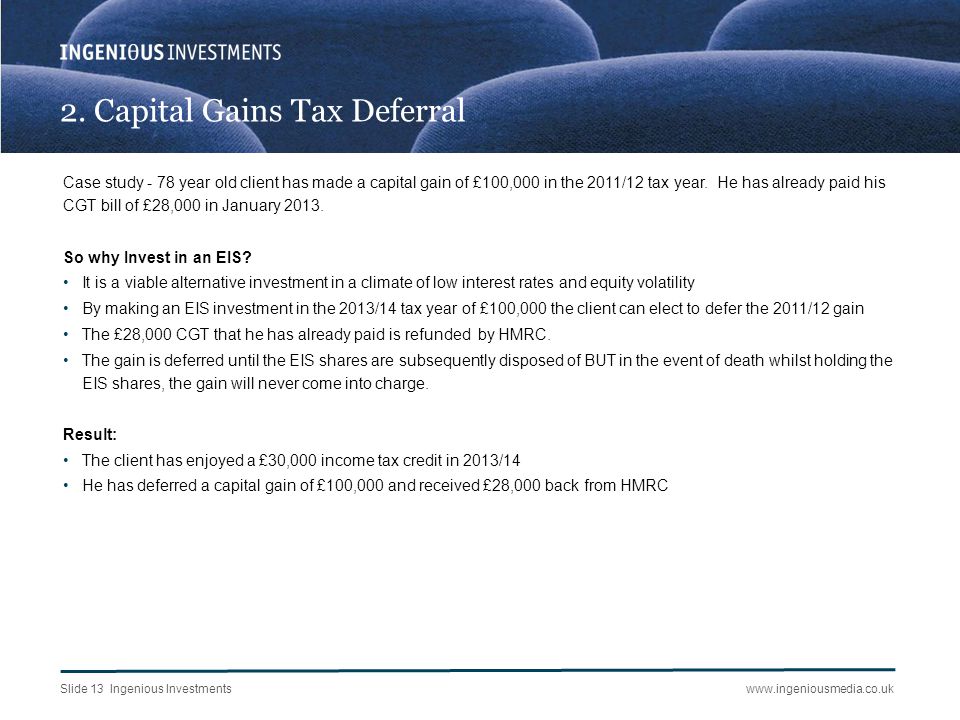

. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares. It explains the capital gains aspects of the Enterprise Investment Scheme EIS. UK tax-paying investors have a number of tax reliefs available to them if they invest in an EIS-qualifying company.

What are the main rules for calculating gains or losses on EIS shares. 100000 Capital Gain Invested via EIS. 7 Methods for Investors 2 days ago May 31 2022 Strategy 1.

The interaction with Entrepreneurs Relief ER In general investors can potentially benefit both from the deferral of gains which can be reinvested under EIS and from ER on. Investing a taxable gain in an EIS allows. Although capital gains tax rates went down to 10 lower.

For the purposes of the Capital Gains Tax Reliefs. Under EIS deferral relief also known as EIS re-investment relief deferred gains are set aside or frozen until the occurrence of specified future events. A gain made on the sale of other assets.

If the gain is. Down Markets Offer Big Opportunities. How are Capital Gains Calculated.

Sell the Property After 1 Year. This guide is for investors. The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain.

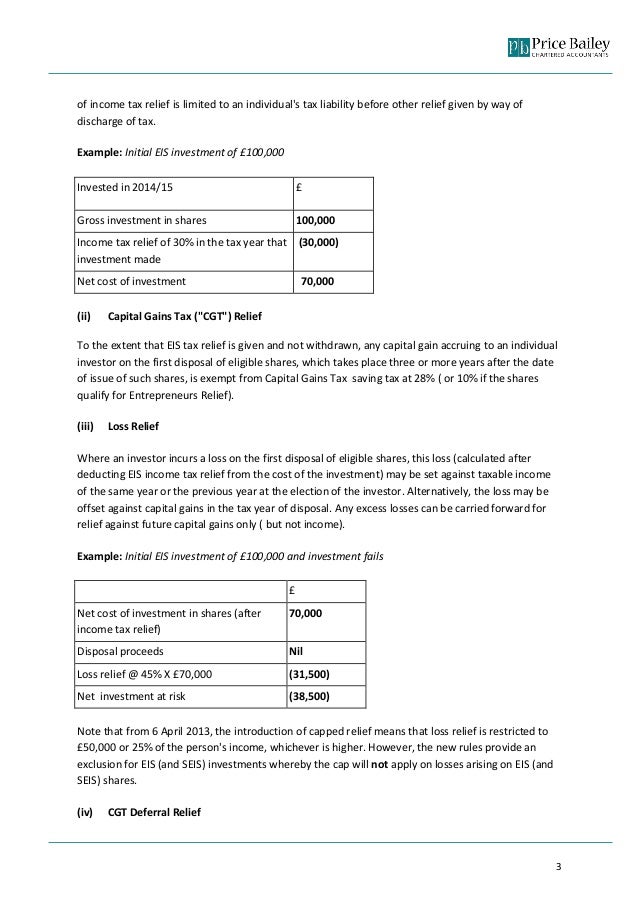

If you have 50000 in long-term gains from the sale of one. 30 of the value of the investment may be set against an individuals income tax bill in the tax year. This chargeable gain is invested.

The normal capital gains rules apply but with exceptions. One year is the dividing line between having to pay short term. Deferring capital gains tax CGT with EIS - SyndicateRoom 1 week ago In this example in 2019 a gain of 16700 is earned.

The gain is deferred until December 31 2026or to the year when the. How to Defer Capital Gains Tax. The base cost of the.

CGT Deferral Relief is claimed via the capital gains tax summary section of your self-assessment tax return and can be claimed upon receipt of your EIS3 certificates the same certificates used. Capital Gains Tax Rates in Other States. What are Capital Gains.

This means that if you invested 50000 in an EIS-eligible investment opportunity and upon disposal your shares were worth 75000 you would have no tax liabilities to pay on. There is a chargeable gain of 5000 beyond the 2019 CGT tax free. This chargeable gain is invested in an EIS fund and capital gains tax of 1000 is deferred.

The investment limits that apply to EIS income tax relief do not apply to deferral relief so relief can be applied to any amount invested in EIS-qualifying shares. So if your investment falls to zero you could in effect deduct the 70000 loss from your taxable income. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares.

Analyze Portfolios For Upcoming Capital Gain Estimates. This includes venture capital schemes disposal relief and deferral. There is also 30 Income Tax relief on the investment.

Deferring capital gains tax CGT with EIS - SyndicateRoom 6 days ago There is a chargeable gain of 5000 beyond the 2019 CGT tax free allowance of 11700. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. How to Defer Tax on Capital Gains - Cobb 1 week ago Feb 01 2019 For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

Defer capital gains by investing in EIS. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Unlike EIS income tax relief there is no minimum period that EIS shares need to be held to benefit from EIS deferral.

Short-Term Capital Gains Tax Rates 2022 and 2021. There are further benefits to investments made under the EIS scheme. Learn How to Harvest Losses to Help Reduce Taxes.

You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. Here are three useful tips to consider to make your capital gains as cost-effective as possible.

Enterprise Investment Scheme Ppt Video Online Download

Jsm Jsm Chartered Tax Advisors Accountants

Velocity Capital Advisors Velocitycapita1 Twitter

Five Reasons Why An Eis May Not Be As Taxing As You Thought

How To Handle Venture Capital Tax Reliefs

How To Legally Avoid Crypto Taxes In 2022 Koinly

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

Eis Investment Working Examples Css Partners Ltd

Tax Efficient Investment Schemes Which Is Best

Tax Relief On Invest In An Enterprise Arthur Hamilton

Agenda Introduction To Ingenious Ppt Video Online Download

The Enterprise Investment Scheme Eis A Guide

Why Winter Is The Perfect Time To Think About Eis And Vct Investments Hfmc Wealth